YOUR GUIDE TO COORDINATION OF BENEFITS AND WHO PAYS FIRST

Having issues with getting reimbursed due to reimbursement disputes between payer groups? Wondering who to bill first?

This question comes up a lot in the field, which tells me, dear reader, that you may be experiencing frequent circumstances in which your Medicare beneficiary patients fall into one or more of these categories:

- The patient is not working and is 65 and older and carries retirement insurance

- The patient has been in an accident resulting in personal injury

- The patient carries a straight Medicare policy with a secondary insurance policy

- The patient carries a straight Medicare policy with a supplemental insurance policy

- The patient has been injured at work

- The patient or patient’s spouse is working and carries group health insurance

In each of the above situations, Coordination of Benefits kicks in, which is the theme of our September article.

According to eHealth, Coordination of Benefits by definition is: “When a person is covered by two health plans, coordination of benefits is the process the insurance companies [payers] use to decide which plan will pay first for covered medical services and what the second plan will pay after the first plan has paid. Coordination of Benefits prevents duplicate payments for the same service on the same date of service, and helps keeps the cost to the patient affordable.”

Let’s look at each of the above circumstances, with resolution for proper claims processing and reimbursement according to the Centers for Medicare and Medicaid Services:

1.) The patient is not working and is 65 and older:

Medicare Pays First if the patient has Retiree health coverage and is not

working

2.) The patient has been in an accident resulting in personal injury

The patient’s no-fault insurance or liability insurance pays first and Medicare

pays second for services related to the accident or injury. *

3.)The patient carries a straight Medicare policy with a secondary insurance policy

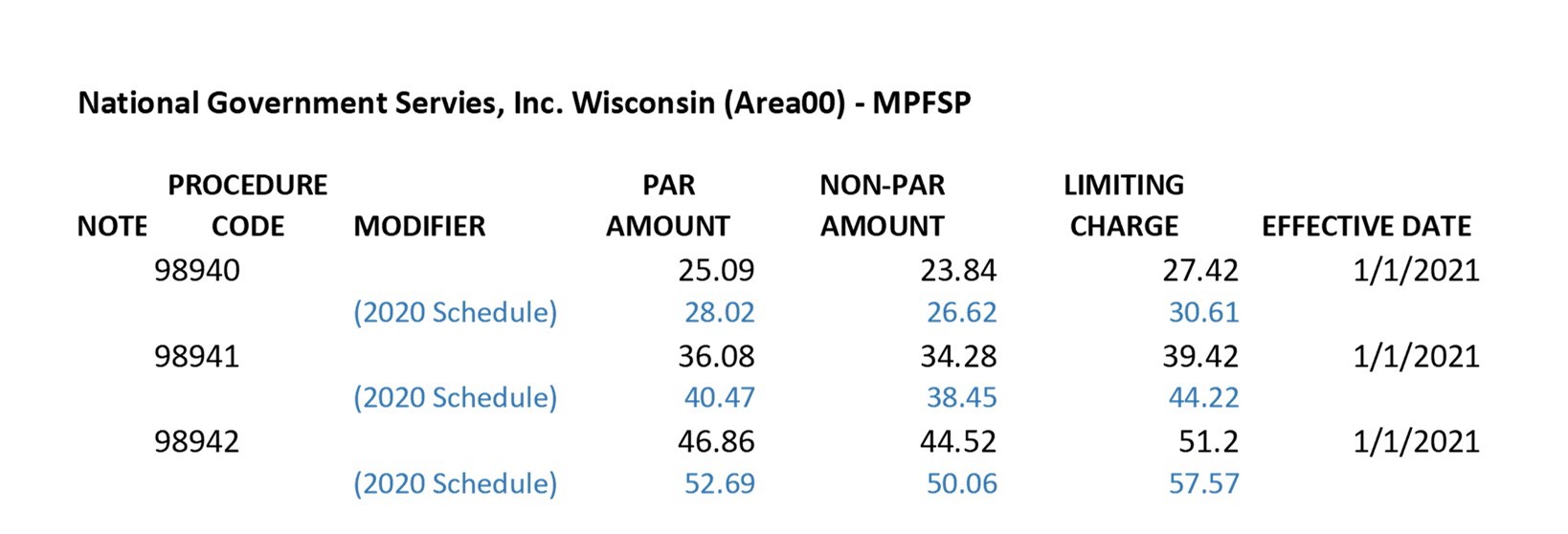

Medicare is billed first and will forward their remittance to the secondary payer if the services are billed with AT (Active Treatment) modifier.

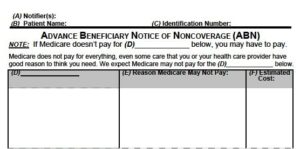

They may or maynot forward to the secondary if the services are billed with a GA modifier (indicating service was a maintenance adjustment), and will not forward if a GZ modifier is billed (indicating a maintenance adjustment but no signed

Advanced Beneficiary Notice (ABN) is on file), since you cannot bill the patient

for a maintenance adjustment without an ABN.

You may need to file the secondary claim for adjudication on the GA adjustment directly to the secondary payer.

==============================================

Do you have questions or need help with:

insurance audits

credentialing new providers

debugging complex insurance issues

customizing billing systems to improve collections,

practice appraisals, and more.

Ask Lisa

Call Lisa: (920) 334-4561 (mobile)

https://pmaworks.com/lisa-barnett/

============================================

4) The patient carries a straight Medicare policy with a supplemental insurance policy

The same applies as with a secondary policy: Medicare is billed first and will

forward their remittance to the secondary payer if the services are billed with

AT (Active Treatment) modifier.

They may or may not forward to the secondary if the services are billed with a GA modifier (indicating service was a maintenance adjustment), and will not forward if a GZ modifier is billed (indicating a maintenance adjustment but no signed Advanced Beneficiary Notice (ABN) is on file), since you cannot bill the patient for a maintenance adjustment without an ABN.

You may need to file the secondary claim for adjudication on the GA adjustment directly to the secondary payer.

5) The patient has been injured at work

Workers’ compensation pays first for items or services related to the workers’

compensation claim. However, Medicare may make a conditional payment if the

workers’ compensation insurance company denies reimbursement. In this case

the patient is financially responsible but Medicare may pay pending the

insurance company’s review of your claim.

6) The patient and/or patient’s spouse is working and carries group health insurance

-

- Medicare pays first in both circumstances if the Employer has fewer than 20 Employees.

- The group health carrier pays first in both circumstances if the Employer has greater than 20 Employees

- If the patient has a disability and that patient or spouse is currently employed at an Employer with 100 or more employees, the group health plan pays first

- If the patient has a disability and that patient or spouse is currently employed at an Employer with less than 100 employees, Medicare pays first

What about in non-Medicare situations where there is a minor child listed as a dependent on dual-spouse or parent policies?

The “birthday rule” is commonly applied for children covered by two employer group health plans. In this situation, the plan covering the parent whose birthday falls first in the year will pay primary on the children; the other parent’s plan becomes the secondary payer.

I hope that this gives you guidance as you navigate through the payer world of coordination of benefits. Have further questions? We can help. Reach out:

lisa@pmaworks.com

920-334-4561

For more info on insurance:

- Ask Lisa: Payer Notes Request, Now What Do I Do?

- Ask Lisa:Revenue Cycle Management (RCM)

- Ask Lisa:What is the Most Important Component of Your Chiropractic Practice

- More Ask Lisa

*The exception would be if the case is being handled by attorney representation and a settlement is forthcoming. You may bill the liability carrier and seek renumeration, in which case the patient is responsible for repaying the carrier (or Medicare) for services rendered at your office, after receiving settlement. You may bill the patient for their care up front, in which case they would need to wait for their settlement monies.

References:

1) https://www.medicare.gov/health-drug-plans/coordination/who-pays-first

2) https://www.medicare.gov/publications/11546-Medicare-Coordination-of-Benefits-Getting-Started.pdf

3) https://www.ehealthinsurance.com/resources/individual-and-family/coordination-of-benefits

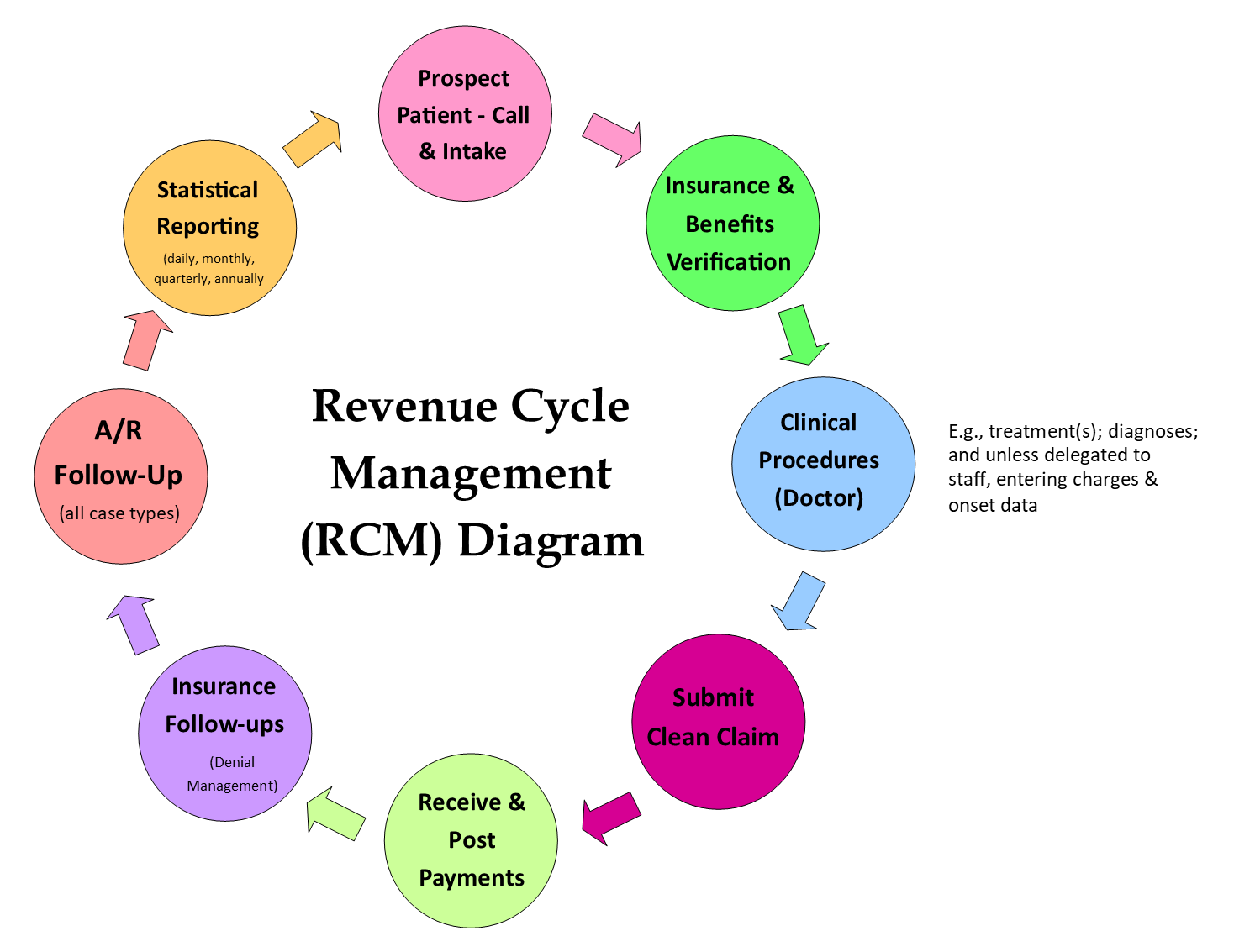

The important thing here is to be consistent, meaning every step and each element of the flow must align with the goals and mission of the clinic. For example, a pediatric/wellness practice will have different polices each step of the way for RCM than a sports medicine clinic would. If you are having issues, you need to examine which step in your RCM is bottlenecked, or which step is not in alignment.

The important thing here is to be consistent, meaning every step and each element of the flow must align with the goals and mission of the clinic. For example, a pediatric/wellness practice will have different polices each step of the way for RCM than a sports medicine clinic would. If you are having issues, you need to examine which step in your RCM is bottlenecked, or which step is not in alignment.

Lisa recently had a phone conversation with United Healthcare for an update on the Change Healthcare Cyber Attack Update Regarding United Healthcare Payments & Remittances. UHC advises that they are close to a resolution on getting all of the clinic remittances available on the provider clearinghouses, and troubleshooting improper denials.

Lisa recently had a phone conversation with United Healthcare for an update on the Change Healthcare Cyber Attack Update Regarding United Healthcare Payments & Remittances. UHC advises that they are close to a resolution on getting all of the clinic remittances available on the provider clearinghouses, and troubleshooting improper denials.

Bravery is one of the themes of our practice manager training program.

Bravery is one of the themes of our practice manager training program.

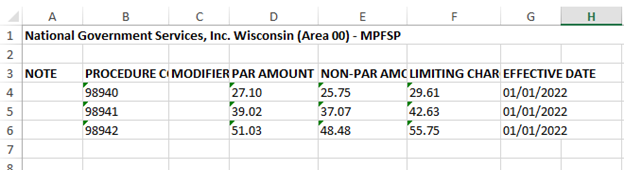

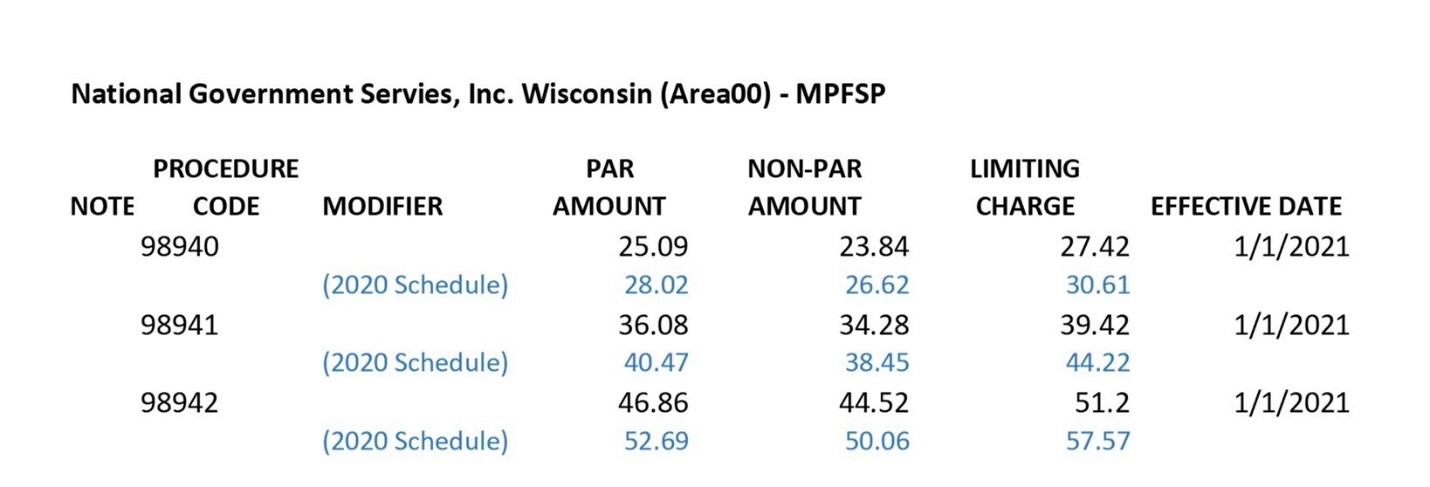

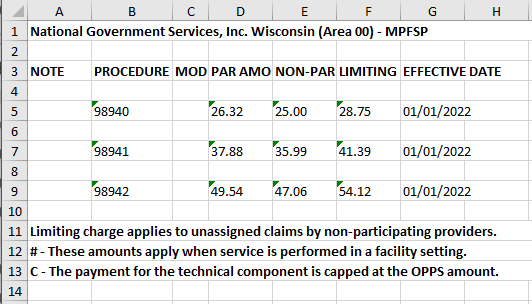

Kiplinger recently shared information from the Centers for Medicare & Medicaid Services reporting that Medicare Part B premiums will jump dramatically in 2022. An increase of 14.5% or $21.60 from 2021. Deductibles will also show an increase of $30.00 going to $233 in 2022.

Kiplinger recently shared information from the Centers for Medicare & Medicaid Services reporting that Medicare Part B premiums will jump dramatically in 2022. An increase of 14.5% or $21.60 from 2021. Deductibles will also show an increase of $30.00 going to $233 in 2022.

Dear Chiropractors and Staff:

Dear Chiropractors and Staff: