Bravery is one of the themes of our practice manager training program.

Bravery is one of the themes of our practice manager training program.

Brave, Not Perfect is the title of an excellent book by Reshma Saujani, and also from her TED talk with the same title. She states that our culture influences girls to be perfect while boys can be wilder, take risks, and make more mistakes. She encourages women to be braver.

I think this can apply to us all.

Practice Manager Success Story

But this newsletter is about a success story. A story of bravery and integrity. It is also to boast about one of our managers who recently graduated from our Goal Driven Practice MBA program for chiropractic and healthcare offices and demonstrated these values.

As the practice manager, she also does the billing in this office. The chiropractic doctor had treated a patient who had suffered a motor vehicle accident. She submitted the bill to a 3rd party, reducing the what was owed slightly as the doctor agreed to discount some of the services.

The 3rd party company came back and said they could only pay 70% of the bill.

This was the manager’s response:

“Good morning,

“Thank you for letting us know.

“We provided 100% of the care that our patient needed; therefore, we require 100% payment of our services we provided. The original discounted offer of $X,XXX is no longer valid.

“We have decided to pursue the full amount plus interest, along with any court/attorney fees if we haven’t received payment in the full amount of $Y,YYY by March 7th.”

“Thank you,

[Signature]

“Manager of Chiropractic Health Clinic”

She received the full amount before March 7th.

Be Brave — with Integrity and Humor

Be nice, be fair, but first, be brave.

This can apply to scheduling patients at the front desk. It applies to reporting on the patient’s condition and treatment plan options. It applies to promotions and advertising. It can apply to training and coaching for you and your team.

It takes courage to become a doctor, to start a business, and even to work as a professional in an independent healthcare clinic. It takes even more to succeed at doing so.

But hey, it can be fun. And it helps to have some humor.

Our manager made a copy of the correspondence with the claims company with a copy of the check. She gave it as a surprise to her clinic director, who sent me a text with the image of what she gave him. On the copy of the email, she included a handwritten quote from the classic comedy movie Princess Bride:

“NEVER GO AGAINST A SICILIAN WHEN DEATH IS ON THE LINE.”

Stay Brave and Goal Driven — and Have Fun.

Ed

P.S. Our next management and leadership training program begins this summer. We have been retooling it and upgrading it. Only 7 students will be accepted. If you are interested, please get on the Wait List, and I will contact you soon with more information. Click here for Wait List for our next Practice MBA

—————————————————-

If your practice building efforts aren’t taking you to your goals,

there are reasons — many of which are hidden from you.

Find out what they are and how to sail to your next level by getting and implementing my new book, The Goal Driven Business.

The Goal Driven Business, By Edward Petty

Bravery is one of the themes of our practice manager training program.

Bravery is one of the themes of our practice manager training program.

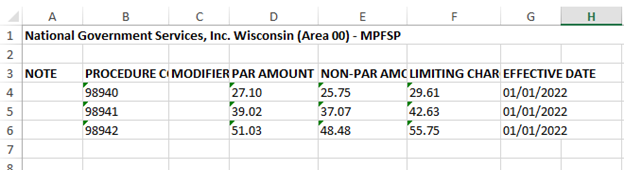

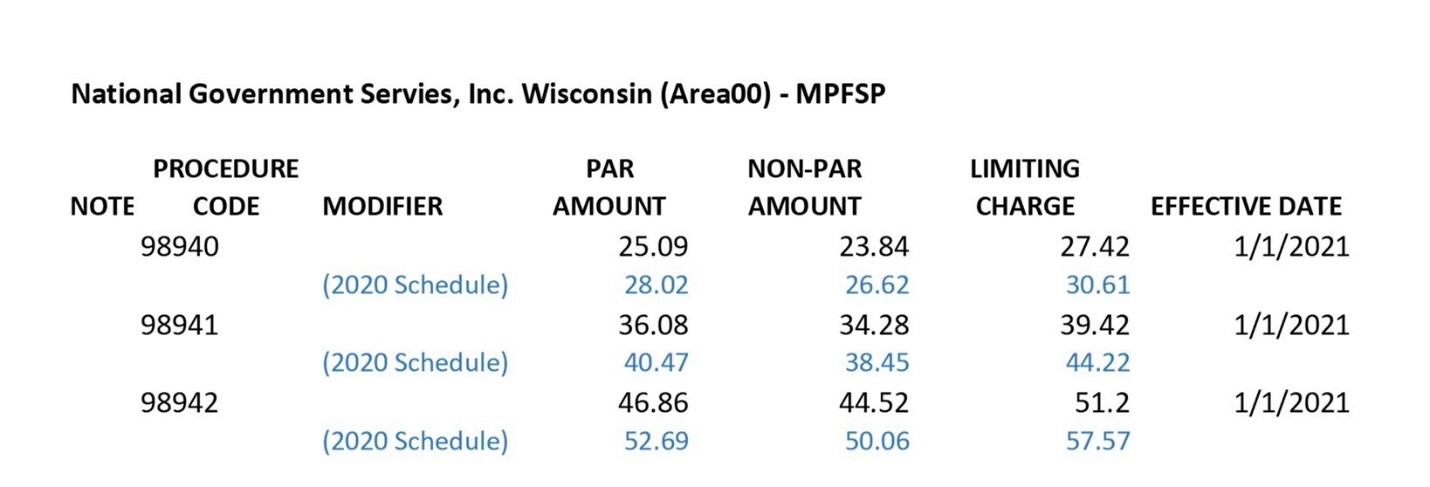

Kiplinger recently shared information from the Centers for Medicare & Medicaid Services reporting that Medicare Part B premiums will jump dramatically in 2022. An increase of 14.5% or $21.60 from 2021. Deductibles will also show an increase of $30.00 going to $233 in 2022.

Kiplinger recently shared information from the Centers for Medicare & Medicaid Services reporting that Medicare Part B premiums will jump dramatically in 2022. An increase of 14.5% or $21.60 from 2021. Deductibles will also show an increase of $30.00 going to $233 in 2022.

Dear Chiropractors and Staff:

Dear Chiropractors and Staff: