“The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn.” Alvin Toffler

I don’t see this discussed much – at least not enough.

It’s called: STUDY. Study is similar to training, which includes practice, and both require real personal effort and engagement to be effective.

You may want to study more but just don’t feel like you have the time to do so. It does take time away from other activities. It can be confusing, tedious, and even seem belittling – sitting down and grinding over information, trying to figure out how something works. Practicing and roll playing can seem even worse.

But the return on your investment is worth it. And nowadays, you have to constantly study just to stay up to date, let alone get ahead. For example, for those of you in the insurance departments – patient accounts – you have probably had to learn many new things lately. You may have had to upgrade your computer programs for electronic health records. You have had to learn about “meaningful use” and other new terms.

But wait, there’s more!

INSURANCE

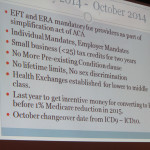

I checked in with our resident billing expert, Mr. Dave Michel, and he informs me you have the following headed your way:

- June: new CMS 1500 claim form

- July: PQRS implementation

- Sept 7: WPS to NGS (Medicare administrator change in several Midwest states.)

- Oct: new ICD 10

- January major provisions of the PPACA and required EFT and ERA

For those of you in charge of patient reimbursement, you will have to learn about these new programs, train and then get them correctly implemented. You have many resources from which to learn, including: association seminars and webinars, the CMS website, Chirocode.com, NGS web site for those of you in the Midwest, the PM&A Members website and Facebook page. There are other resources as well, but the point is that you will have to study, learn, and work it out and get it implemented.

FRONT DESK AND OTHER CLINIC DEPARTMENTS

This also applies to every other job in your office. Each team member should be able to write a book about their department and job within five years and be capable of presenting a full day seminar on what they do to other chiropractic staff.

The front desk should be experts in customer service, sales for scheduling, and excellent in many other skills. Therapy and rehab staff should know the physiological affect their machines and protocols produce for their patients. They too need to be exceptional at patient education, customer service, and as compassionate as the patient’s mother.

YOU ARE PROFESSIONALS

These are high standards, but you are professionals. You don’t work on an assembly line at the Ford plant. We now live in a networked economy. We have long since passed the Industrial Age, even though most of our management techniques still seem tied back to when “Father Knows Best.”

There is no getting around it, this is a new age. Alvin Toffler, quoted above, wrote about post the Industrial age for business in his book, The Third Wave. The second wave was the Industrial Age – and the third was and is the Information Age.

It is 2013 and your patients are smarter than patients have ever been and expect more. They know about you before they call you and report on you after they see you so the whole world knows how you treated them.

You have to be better. You have to study, learn, train. In a tough economy, patients will go to the best and bypass the rest. You have to be the best.

A NOTE TO DOCTORS

This apples to you doubly. Beyond the continuing education credits, I suggest you consider challenging yourself to constantly work on improving any and every aspect of your clinical craft like a true artisan. Like a scientist. And like a philosopher.

But you are also a CEO, which includes an entirely different set of skills. As the owner and manager of your business, you need to perfect your skills as a leader, manager, and marketer. This is so horribly omitted (or perverted) in many programs as to be either laughable or criminal. Once you do learn these subjects, you can delegate most of them and we can show you how, but you need to learn them nevertheless.

ONE HOUR PER WEEK

Stephen Covey talks about how you have to “sharpen the saw.” You can cut a tree much faster if the saw is sharp and that sharpening is called training and study. According to the American Society for Training and Development, since 1991, annual training budgets in the U.S. have grown from $43.2 billion in 1991 to $156 billion in 2011. Obviously, business sees an ever increasing need for training.

Encourage your team to take at least one hour each week to study some aspect relating to their job. Encourage them to attend seminars and webinars and tele-classes, and have them give a presentation for the entire team at the next team meeting about what they learned. You can give them a bonus if they give a book report about a book they read in the Lending Library.

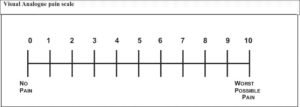

YOUR PATIENTS

Lastly, this also applies to your patients. One of the primary functions of your office should be the training and education of your patients. They need to take responsibility for their own health and in order to do this – they need to know what you know. Regular care classes, a “lending library” and of course, warm “table talk” by doctor and staff help.

***SPECIAL TEAM TRAINING TELECLASS WITH PHYLLIS FRASE AND DANA PITTNER TUESDAY, MAY 21,

12:30pm – 1:30pm CDT – “Dialogues and Dilemmas”

Take time this Tuesday to listen to these dynamic ladies discuss solutions to the 10 most common conversations staff often gets stuck on with patients.

Learn how your staff can share and educate your patients on the chiropractic lifestyle. What you can say at the front desk, in therapy, financials, etc.

There is no charge for this teleclass. For active PM&A members, you will find it on you Members site in a few days just in case you missed it.