More and more, insurance companies are doing post payment audits or hiring outside firms to conduct payment reviews and requesting money back from your chiropractic office.

Refunds should never be automatically sent out based on a request from an insurance company. Each request needs to be individually reviewed and processed and the patient’s account should be audited to determine if a refund is actually due and to whom.

Sometimes, a refund is due. Examples may be when an insurance company has double paid dates of service, or when two insurance companies both pay on the same date of service. These are legitimate refunds – ie: you have been paid more than you billed or were due for services rendered. These should be refunded.

Often however, a refund is NOT due and should be disputed. Examples might be when an insurance company or third party does a “post payment review” and determines that the care was not medically necessary, or when insurance pays but later determines that work comp or PI were primary, or when an insurance company decides that the patient did not have a particular benefit or coverage for what they already paid.

Essentially, when you have delivered quality services to a patient that were medically necessary and in the best interest of the patient, and the insurance company pays for those services, you have NOT been overpaid and no refund is due. Even if the insurance company later decides they overpaid or paid in error. These refund requests should always be disputed.

Legally, you are not obligated to repay the insurance company when you have been paid in good faith for services rendered and they paid in error. These should always be disputed.

This will not stop some insurance companies from ‘recouping’ the payment, but you should still attempt to dispute the refund request first. Our experience is that by disputing the refund you will avoid 85% of all refund requests. It is well worth the time and effort to do so.

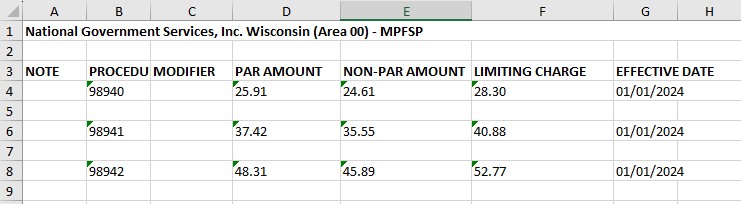

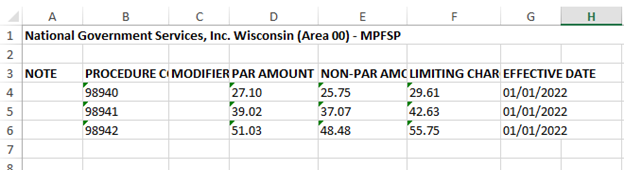

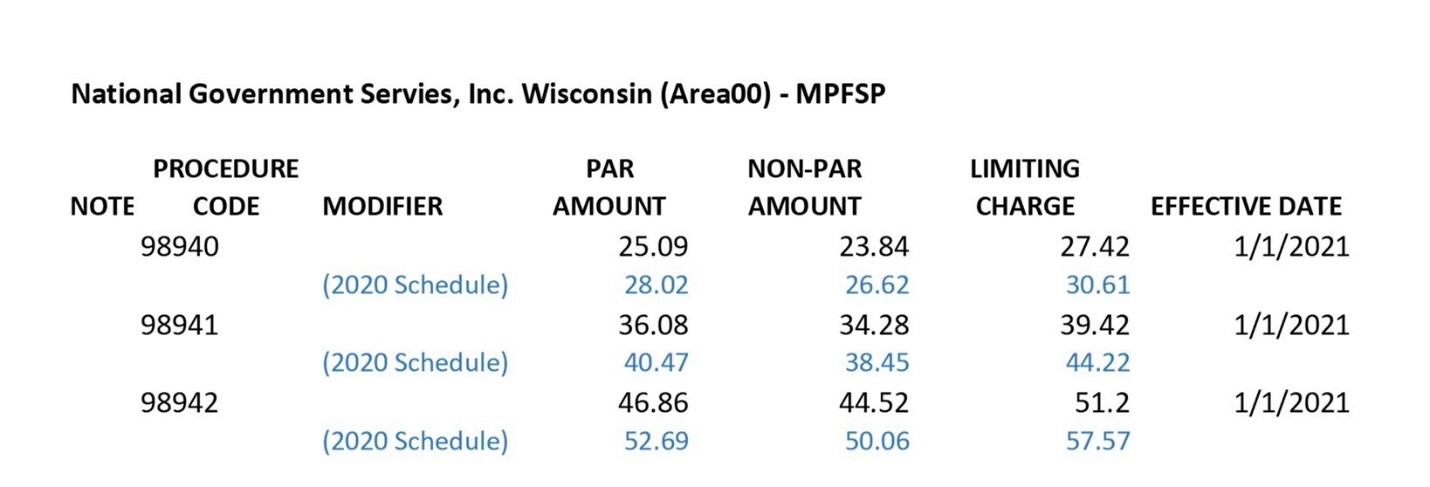

The exception to the above involves government programs such as Medicare and Medicaid. We generally advise refunding these right away and THEN disputing the request. Remember that you must use the approved Medicare refund form and mailing address (check on line with yur local Medicare carrier for the latest form and address).

Points that can and should be used whenever disputing a refund include these (use any and all reasons that are applicable to each case):

– All services were medically necessary for the health of the patient. Our review indicated that the care was medically necessary; therefore no refund will be issued.

– This request is for a patient no longer active with our office. We have no alternative methods of collecting on these accounts. Because of a supposed error on your part, you are asking us to refund monies to you for services rendered to your insured without a foreseeable ability to collect for said services.

– We called/verified benefits on line with (Insurance Company) on each of these patients prior to the delivery of care and verified coverage for services rendered by our office. Had we been informed, we or the patient could have made a more informed decision regarding the delivery and payment for care.

– It is our understanding that (Insurance Company) has maintained a policy of not reimbursing for services if they are submitted for payment one year or longer after delivery. You are requested a refund for services over two years after their delivery and payment. It would seem that the policy should apply both ways.

– Your letter mentions that 98940 and 97140 are mutually exclusive. This is not the case when they are performed in different regions of the body as defined by the AMA. You also state that manual traction and mechanical traction are mutually exclusive. Again, this is not stated in the AMA CPT codebook and the services were performed by different providers, as our chart records show.

– The time and effort to have our office pull charts and research services from 2009 and 2010 is considerable and cannot be done without prior reimbursement, nor can these records be forwarded to (Insurance Company) without prior consent from the patient.

– We would also like to know if you have informed this patient, in writing, that due to the error on your part, that they are now liable for their medical bill from 2009?

– Our feeling is that the following court cases concluded that the insurance company is responsible for knowing their policy limits prior to paying and therefore must bear the responsibility for their own mistakes.

- City of Hope National Center vs. Western Life Insurance Company, 92 Daily Journal D.A.R. 10728, Decided July 31, 1992. (In this case the hospital obtained standard assignment of benefits from the patient and submitted claims, which were paid by the carrier. The insurance company later decided the treatment was experimental and requested the money back. The California Court of Appeals stated that if it’s your mistake you have to pay for it.

- In Federated Mutual Insurance Company vs. Good Samaritan Hospital (Neb. 1974) 214 N.W.2d 493. (The carrier contended that it mistakenly paid claims beyond the policy limits. The court held that the insurance company could not recover the money as it places an undue burden on the providers of service to subject them to retroliability.)

- Lincoln Nat Life Ins vs. Brown Schools (Ct.App. Tex 1988) 757 S.W. 2d 41 1. (In this case the carrier mistakenly paid claims after its policy had expired. The court denied recovery stating “Here the insurer knew it’s own policy payment provisions, but failed to notify the health care providers as to these provisions and the insurer alone made the mistake of paying beyond its responsibility . . . in the normal course of such business, the hospital has no responsibility to determine if an insurance carrier is properly tending to its business.”)

- National Ben. Administrators Vs. MMHRC (S.D. Miss. 1990). (Similar case as #3 with same conclusion.)

– Our office made no misrepresentations in filing claims for your insured. We extended valuable services based on preverification of benefits and assignment of payment by the insured. We were not unjustly enriched, and simply had no reason to suspect that any of the payments for services rendered were in error. Refunding the monies at this time would place an undue burden on our office.

As always, send a copy of your letter to the patients involved. The insurance company will send a letter to the patient (if we don’t send them a check) saying that “we are not cooperating and therefore the patient may be responsible”. So, strike first by presenting our side and preparing the patient.

Situation: The insurance company paid twice on one date of service and missed payments on another. They are now requesting repayment on the double payment.

Solution: Send them a letter explaining that the payments were posted to the unpaid dates and no refund will be made.

Situation: The insurance company claims that the work comp carrier is responsible for payment and is asking for all their money back.

Solution: Send them a letter explaining that you will bill the work comp carrier and if and when payment is received, you will refund any duplicate payment.

Situation: The insurance company paid for the first eight visits, then denied the next five and now wants a refund on what they paid.

Solution: Dispute the refund as per the above points and request immediate payment on the five denied visits.

Situation: The insurance company paid for care, but then came back and stated the patient didn’t have an active policy or coverage.

Solution: Dispute the refund as per the above points. It is the insurance company’s job to pay within the limits of their plan; you have been paid for services rendered.

If you have questions, feel free to contact me.

David Michel