In today’s healthcare landscape, verifying a patient’s insurance benefits is more than an administrative step – it is a critical safeguard for both the patient and you. Benefits verification ensures that coverage details such as eligibility, co-payments, deductibles, and authorization requirements are clearly understood. When done accurately and promptly, this process lays the foundation for transparent care, financial clarity, and trust.

For your patients, unverified benefits can lead to unexpected bills, delayed treatment, or denied claims long after services are rendered. These surprises not only often create stress at moments when patients are already vulnerable, but become a compliance issue with regards to the No Surprises Act. Verifying benefits in advance also empowers patients with accurate information about their financial responsibility, preventing fears about surprise charges.

From your perspective, benefit verification reduces claim denials, improves your revenue cycle management, and supports effective, functional operations. It bridges the gap between clinical care and financial responsibility, ensuring that your services provided align with billing requirements. Ultimately, verifying benefits is not just about reimbursement, it is about protecting patients, strengthening provider-patient relationships, and promoting a more transparent and sustainable practice.

The best time to verify benefits in the chiropractic office is either 1) before the new patient’s Day 1 if you obtained their insurance information when they called or came in to schedule, or 2) After the patient’s Day 1 visit and prior to their Day 2 visit. This fosters continued trust and adequate time for your one-on-one financial consultation. You’ll also want to verify benefits if the patient has a change in insurance during the year.

Best Verification Methods: How to Verify Benefits

- EHR/Clearinghouse: For a minimal extra monthly fee, verification of benefits feature is available for immediate output through your EHR or clearinghouse.

- Insurance Payor Portals: Using specific payer websites provides the most up-to-date, detailed, and accurate benefit information, often surpassing phone checks.

- Phone: The most reliable method for complex or high-cost services, enabling confirmation of specific benefits, authorization requirements, and obtaining a first name and reference number for the call.

Be ready to provide the following information:

- Patient Name

- Date of Birth

- Member ID

- Group Number (if applicable)

Some Coverage Questions/Criteria:

- In-network or out-of-network status of provider

- Annual or visit limits (if any)

- Deductible amount and remaining balance

- Co-payment or coinsurance

- Is prior authorization required

- CPT codes

- Effective date of coverage and if calendar year or policy year coverage

If an appeal is needed:

When you need to appeal a benefits verification that mismatches the reimbursement on your EOB, the best method is to call the payer regarding the specific issue and provide the call reference number and representative’s name if you originally called to verify. If you used your EHR/clearinghouse or the payer’s portal, provide the information stated on the printout to the appeals representative. Focus on what you need for resolution, such as, “It appears your claims system miscalculated what we are to be reimbursed. We are expecting $XX remaining, and are requesting you resend the claim(s) to process per the member’s policy coverage.” If they paid correctly on another DOS, let the rep know this.

You may want to inform the patient of your appeal as well. Sometimes the patient will need to ultimately call to sort out a coverage dispute. If they signed your financial agreement, they’ll be more than willing to call their insurance company if they were expecting their insurer to pay a portion for their care.

Need an insurance verification form for use or to compare what you currently use in your office? Click HERE for an insurance verification form. On the house.

Questions? Just Ask… Lisa

As a follow-up to our previous compliance articles, I thought what I’d do this month is put together a FAQ list for my dear readers and call it Compliance 201. Keep reading to learn about upcoming new requirements in the compliance/cybersecurity world to keep you at least safe-guarded when you are hit with a cybersecurity incident. Special thanks and credit goes out to ChiroArmour and Dr. Scott Muensterman for his research and presenting at the Chiropractic Society of Wisconsin Fall Experience last month on some of the content in my FAQ.

As a follow-up to our previous compliance articles, I thought what I’d do this month is put together a FAQ list for my dear readers and call it Compliance 201. Keep reading to learn about upcoming new requirements in the compliance/cybersecurity world to keep you at least safe-guarded when you are hit with a cybersecurity incident. Special thanks and credit goes out to ChiroArmour and Dr. Scott Muensterman for his research and presenting at the Chiropractic Society of Wisconsin Fall Experience last month on some of the content in my FAQ.

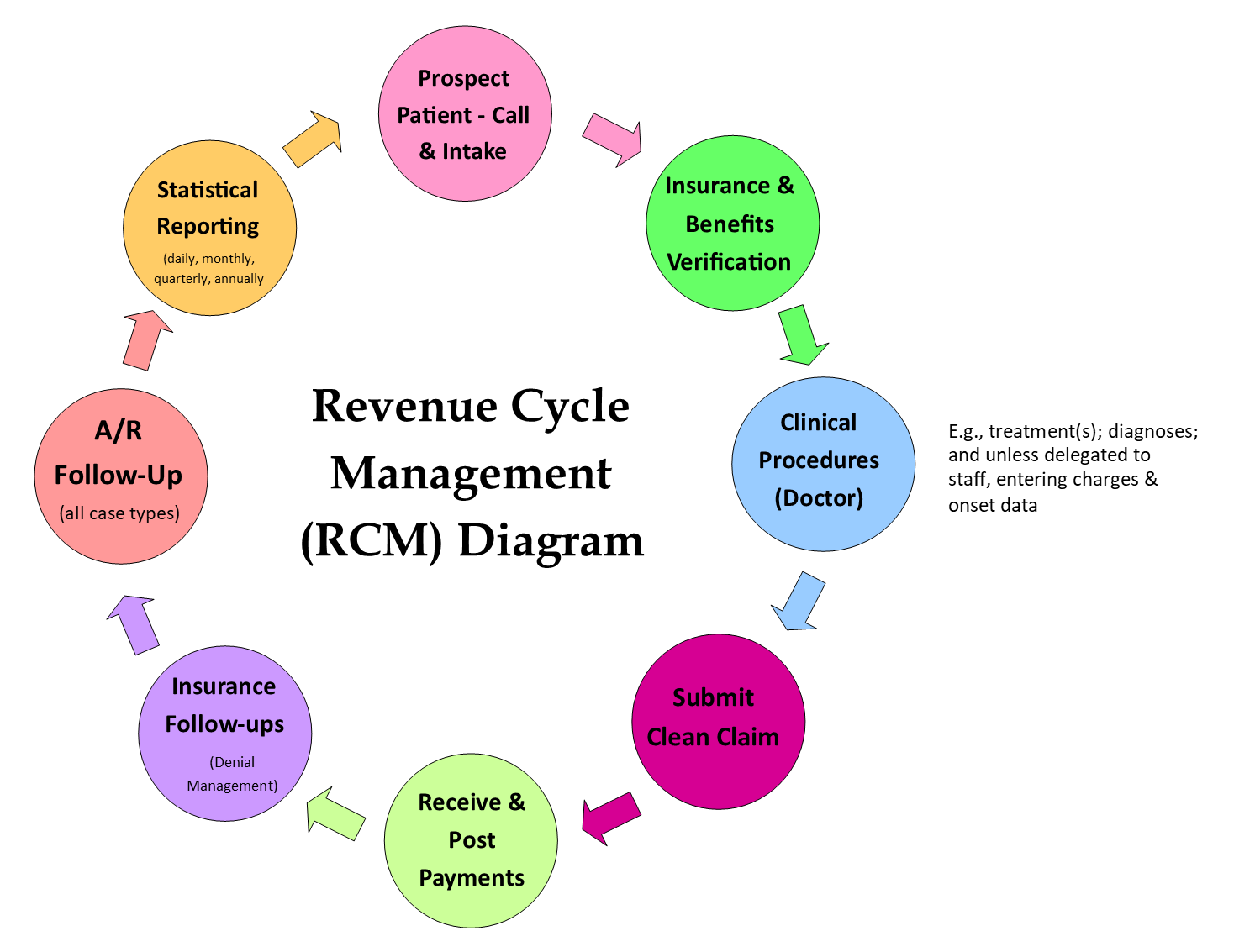

The important thing here is to be consistent, meaning every step and each element of the flow must align with the goals and mission of the clinic. For example, a pediatric/wellness practice will have different polices each step of the way for RCM than a sports medicine clinic would. If you are having issues, you need to examine which step in your RCM is bottlenecked, or which step is not in alignment.

The important thing here is to be consistent, meaning every step and each element of the flow must align with the goals and mission of the clinic. For example, a pediatric/wellness practice will have different polices each step of the way for RCM than a sports medicine clinic would. If you are having issues, you need to examine which step in your RCM is bottlenecked, or which step is not in alignment.

Lisa recently had a phone conversation with United Healthcare for an update on the Change Healthcare Cyber Attack Update Regarding United Healthcare Payments & Remittances. UHC advises that they are close to a resolution on getting all of the clinic remittances available on the provider clearinghouses, and troubleshooting improper denials.

Lisa recently had a phone conversation with United Healthcare for an update on the Change Healthcare Cyber Attack Update Regarding United Healthcare Payments & Remittances. UHC advises that they are close to a resolution on getting all of the clinic remittances available on the provider clearinghouses, and troubleshooting improper denials.