Have you every wished there was an easy way to make sense of the labyrinth of insurance networks out there?

Should you be in? Should you opt out?

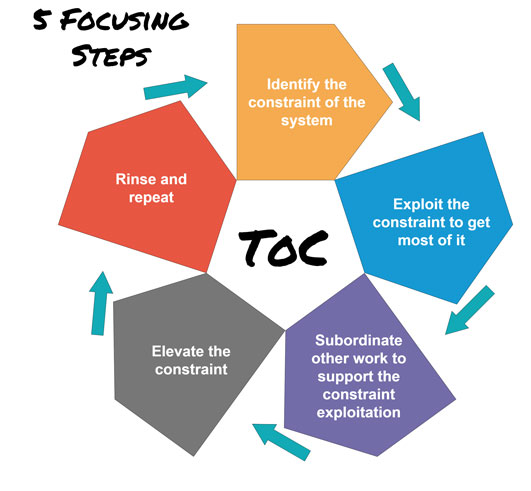

Below is a guide for you and your staff to follow to help you decide whether pursuing a specific insurance contract, and staying in, is worth your time and investment.

First, determine which companies you are in network with. Do you have a contract? What are your obligations as a provider? Are you getting reimbursed what the contracted fee schedule says it will reimburse? Do you have a profile set up with the National Council for Affordable Quality Healthcare (CAQH) universal provider database and is the information current, and reviewed and attested quarterly? There is no charge to create and maintain your profile in this credentialing database.

Second, make sure you know if you are currently enrolled in Medicare and if you are a participating or non-participating provider. Are you also currently enrolled as a provider in your state’s Medicaid program? Is your organization/group also enrolled?

Third, audit your patient demographic. Run a report in your practice management software.

- What percentage of your reimbursement is coming from insurance?

- What percentage is coming directly from patients?

- Which payers are you mainly seeing patients from?

- Are you finding that patients are requesting you be in network with a certain company?

- Who are the main employers in your area insured with?

- Are you enrolled as a provider with the Veteran’s Administration in your area?

Fourth, make a list of Insurance Networks you are with to clarify if questions arise later regarding participation. Review if you have fee schedules and contracts on file.

Once you have a grasp on the above, you’re ready to determine if you need to pursue network participation with additional companies. Treating this like a sales or business venture, you’ll want to have insurance companies coming to you and requesting you to be in their network. Remember, it is to their benefit and their obligation to keep their paying policyholders happy. Patients should feel free to call their insurer requesting you be on their plan. Patients have done this, and outcomes have been successful. Why?

Because the worst phone call that an insurance company can receive is from an upset policyholder who can’t afford to see their favorite doctor who is helping them because the doctor is not on the plan.

Things to consider prior to enrolling in a plan include:

- What is the reimbursement rate?

- What percentage of the approved charges are taken out for contract discounts?

- Is there a fee to join?

- What are your obligations as a provider?

- Do they want you to participate in their workers compensation, PI programs? (In our experience, opting in to the WC and PI products means no steerage to you, and cut reimbursements).

- Are there pre-authorizations required prior to care?

- Is there a visit limit?

- What is the initial credentialing and re-credentialing process?

Now, you are on all the plans that are making your pocketbook and your patient happy. What do you need to do to maintain your in-network status? You will need to notify a payer with updated clinic information anytime there is a change in information you submitted at enrollment. This includes address change or adding a new provider to the office.

Many of the larger commercial payers such as Blue Cross, Humana, United Healthcare/Optum Physical Health, use CAQH to approve your re-credentialing. Those who do not will send a written communication via mail or email letting you know your recredentialing is coming due and will include the applications and instructions. Make sure to track these dates in your insurance spreadsheet.

You will also need to make sure you are tracking re-credentialing timeframes for each insurance company. Typically, the recredentialing process for commercial payers is every three years but since your enrollments with each payer fall on different dates, your re-credentialing due dates will vary. Your Medicare re-credentialing is every five years for both individual and group enrollments. Re-validation with Medicaid programs is typically every three to five years, depending on your state’s standards. For example, it is every three years in WI and every five years in MI.

We’ve just touched the surface of network plans and credentialing. Email me for assistance with how these processes work for your practice.

You may reach me at lisa@pmaworks.com

Lisa

Ask Lisa

Increasing your collections through better billing and documentation

As a follow-up to our previous compliance articles, I thought what I’d do this month is put together a FAQ list for my dear readers and call it Compliance 201. Keep reading to learn about upcoming new requirements in the compliance/cybersecurity world to keep you at least safe-guarded when you are hit with a cybersecurity incident. Special thanks and credit goes out to ChiroArmour and Dr. Scott Muensterman for his research and presenting at the Chiropractic Society of Wisconsin Fall Experience last month on some of the content in my FAQ.

As a follow-up to our previous compliance articles, I thought what I’d do this month is put together a FAQ list for my dear readers and call it Compliance 201. Keep reading to learn about upcoming new requirements in the compliance/cybersecurity world to keep you at least safe-guarded when you are hit with a cybersecurity incident. Special thanks and credit goes out to ChiroArmour and Dr. Scott Muensterman for his research and presenting at the Chiropractic Society of Wisconsin Fall Experience last month on some of the content in my FAQ.

Are you struggling with collections, insurance demands, and general demands on your time? Or know anyone who is?

Are you struggling with collections, insurance demands, and general demands on your time? Or know anyone who is?