Lisa J. Barnett

Download a PDF of this article

Hello Friends in Chiropractic!

Hope you had an awesome summer and took several opportunities to soak in some UV and Vitamin D.

This month I’d like to both expand on my July Medicare Documentation article and coach you on self-auditing evaluation and management (E/M) coding for reimbursement. Are you consistently under-coding your E/M services? It is not benefiting you to do this because more than likely you’re meeting required elements and not getting the best reimbursement available.

So, what exactly does an auditor, be it Medicare or a Commercial Payer look for in determining reimbursement for your evaluation and management services? It is pretty simple and based on both quality and as it turns out, more importantly, quantity of certain elements. Let’s look in depth how you can self-audit your E/M services*:

First, a coding history and review. In 1992, the current E/M codes were introduced as a result of a ten-year study by CMS(Centers for Medicare and Medicaid Services) and the AMA(American Medical Association). Then in 1995 and 1997, CMS and the AMA developed documentation guidelines (DG) for use of these E/M codes.

Without re-inventing the wheel, let’s lay out how you determine which code to use for your patient evaluations and management of care. To review,

- New patient E/M codes include 99201, 99202, 99203, 99204, and 99205.

- Established patient E/M, or re-exam, codes include 99211, 99212, 99213, 99214, and 99215.

Charting out information from CMS and ACA’s ChiroCode book, here is what we have as quantifiable elements to determine which code to bill for. Keep in mind that Necessity of Care drives our discussion below.

History, Exam, Complexity of decision-making are the three main elements in the evaluation and management note.

Let’s now diagram out for you each code and corresponding description of each element, using both New Patient and Established Patient criteria. What differences do you see? Which descriptions share commonality?

NEW PATIENT

| CODE |

HISTORY |

EXAM |

COMPLEXITY OF DECISION-MAKING

IN MANAGEMENT OF CARE

|

| 99201 |

Focused/Minor severity |

Focused |

Straightforward |

| 99202 |

Expanded/Low-to-moderate severity |

Expanded |

Straightforward |

| 99203 |

Detailed/Moderate Severity |

Detailed |

Low |

| 99204 |

Comprehensive/Moderate to high severity |

Comprehensive |

Moderate |

| 99205 |

Comprehensive |

Comprehensive |

High |

ESTABLISHED PATIENT

| CODE |

HISTORY |

EXAM |

COMPLEXITY OF DECISION-MAKING IN MANAGEMENT OF CARE

|

| 99211 |

No key component(s) required |

No key component(s) required |

No Key component |

| 99212 |

Expanded/Low-to-moderate severity |

Expanded |

Straightforward |

| 99213 |

Detailed/Moderate severity |

Detailed |

Low |

| 99214 |

Comprehensive/Moderate to high severity |

Comprehensive |

Moderate |

| 99215 |

Comprehensive |

Comprehensive |

High |

Building on that, here are the quantified components indicating the minimum number of each component’s required presence in the note to code appropriately and at the maximum level:

NEW PATIENT

|

HISTORY |

EXAM |

COMPLEXITY OF DECISION-MAKING

IN MANAGEMENT OF CARE

|

| Code |

Chief Complaint |

HX of Present Illness |

Review of Systems |

Past Family/ Social HX |

Exam (1997 DG) |

Diagnoses |

Data to be reviewed; # of Complaints |

Risk Factors |

| 99201 |

1 |

1 |

N/A |

N/A |

1 in affected body area |

1 |

1 |

Minimum |

| 99202 |

1 |

1-3 |

1 |

N/A |

1-5 |

1 |

1 |

Minimum |

| 99203 |

1 |

4+ |

2-9 |

1 |

6-11 |

2 |

2 |

Low |

| 99204 |

1 |

4+ |

10+ |

2-3 |

12+ |

3 |

3 |

Moderate |

| 99205 |

1 |

4+ |

10+ |

2-3 |

All components |

4 |

4 |

High |

All 3 elements are required in the new patient note to consider reimbursement: History, Exam, Complexity

ESTABLISHED PATIENT

|

HISTORY |

EXAM |

COMPLEXITY OF DECISION-MAKING

IN MANAGEMENT OF CARE

|

| Code |

Chief Complaint |

HX of Present Illness |

Review of Systems |

Past Family/ Social HX |

Exam (1997 DG) |

Diagnoses |

Data to be reviewed; # of Complaints |

Risk Factors |

| 99201 |

1 |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

| 99202 |

1 |

1-3 |

N/A |

N/A |

1-5 |

1 |

1 |

Minimum |

| 99203 |

1 |

1-3 |

1 |

1 |

6-11 |

2 |

2 |

Low |

| 99204 |

1 |

4+ |

2-9 |

2+ |

12+ |

3 |

3 |

Moderate |

| 99205 |

1 |

4+ |

10+ |

2+ |

All components |

4 |

4 |

High |

Two (2) out of the 3 elements are required in the established patient note to consider reimbursement: History, Exam, Complexity

As you may deduce from the above established patient table, 99211’s are rarely used in chiropractic offices. Can you see why?

Additionally, give your current score an extra two points for management of care, i.e., reviewing old records and summarizing in the note stability/worsening of condition, or, two points for obtaining history from someone other than the patient. Add one point for diagnostics performed and reviewed, (i.e., x rays).

Finally, make sure to attached your -25 modifier on all E/M codes if you are giving a CMT on the same DOS.

Have a specific patient in mind and you’d like to find out if you coded and billed at the most appropriate and highest level? Contact me on how you can qualify for a complimentary audit! Call 920.334.4561 or email lisa@pmaworks.com

Sincerely in Chiropractic,

Lisa Barnett,

PM&A Coach and Consultant

Where Managing by Numbers and Progress Says It All.

My purpose is to be the Best Chiropractic Advocate in the World

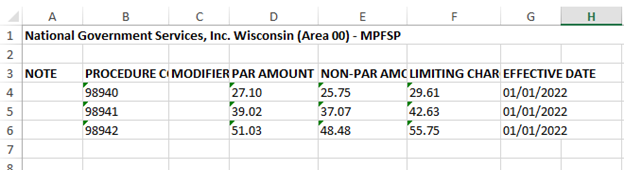

*EHR systems may already have built-in features to automate the components for you via their macros/templates.References:

- American Chiropractic Association ChiroCode Deskbook, 2014-2017

- Centers for Medicare and Medicaid Services, 1997 Documentation Guidelines for Evaluation/Management Services, Reference II, Medicare Physician Guide, A Resource for Resident Physicians, Practicing Physicians, and Other Healthcare Professionals

- Centers for Medicare & Medicaid Services, Medicare Learning Network, ICN006764, August 2015, https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNEdWebGuide/Downloads/97Docguidelines.pdf

- Gwilliam, Evan M., DC, MBA, BS, CPC, NCICS, CCPC, CCCPC, CPC-I, MCS-P, CPMA

List of Components:

History of Present Illness – Elements:

Location (example: left leg); Quality (example: aching, burning, radiating pain); Severity (example: 90 on a scale of 1 to 100); Duration (example: started 3 days ago); Timing (example: constant or comes and goes); Context (example: lifted large object at work); Modifying factors (example: better when ice/heat is applied); and Associated signs and symptoms (example: numbness in toes)

Review of Systems:

Constitutional Symptoms (for example, fever, weight loss); Eyes; Ears, Nose, Mouth, Throat; Cardiovascular; Respiratory; Gastrointestinal; Genitourinary; Musculoskeletal; Integumentary (skin and/or breast); Neurological; Psychiatric; Endocrine; Hematologic/Lymphatic; and Allergic/Immunologic

Past Family/Social History:

Past history includes experiences with illnesses, surgeries, injuries, and treatments/medications. Family history includes a review of medical events, diseases, and conditions that may place the patient at risk. Social history includes an age-appropriate review of past and current lifestyle activities.

To download the article in it’s entirety click the here [LINK]

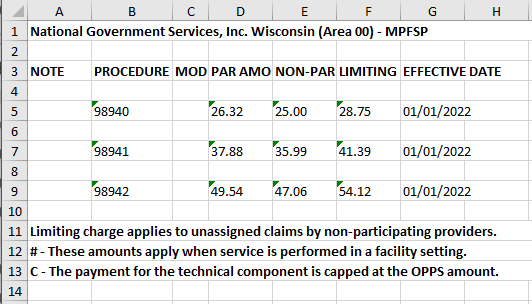

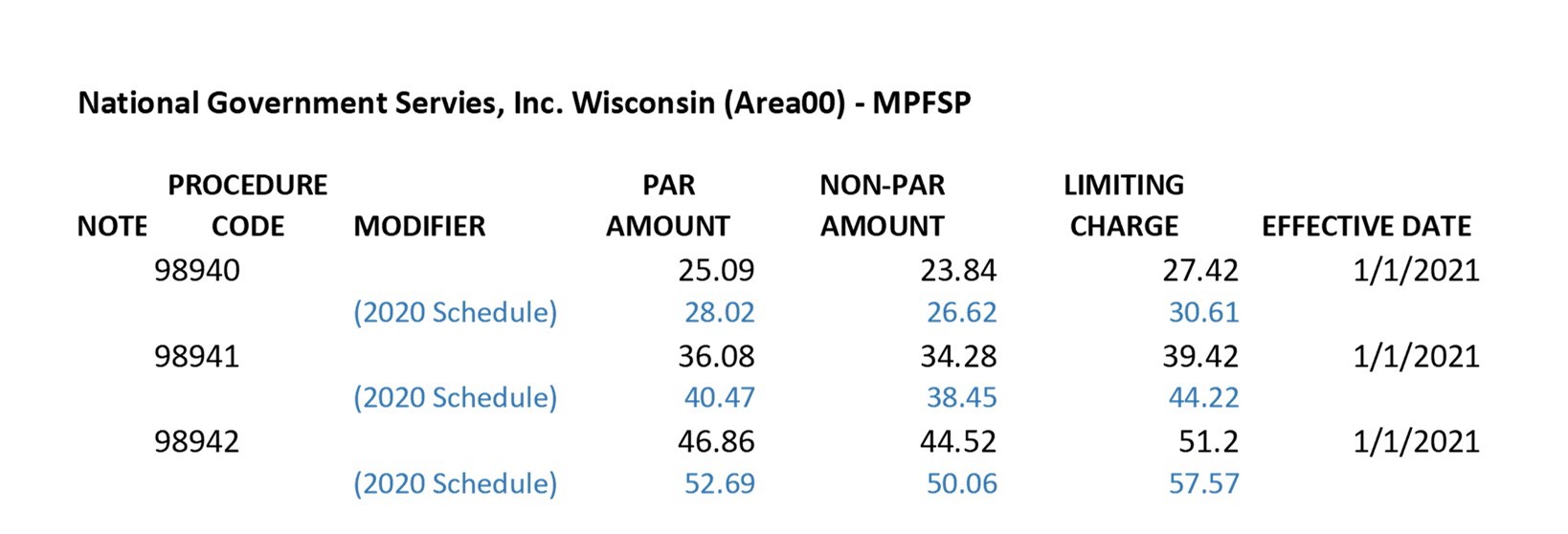

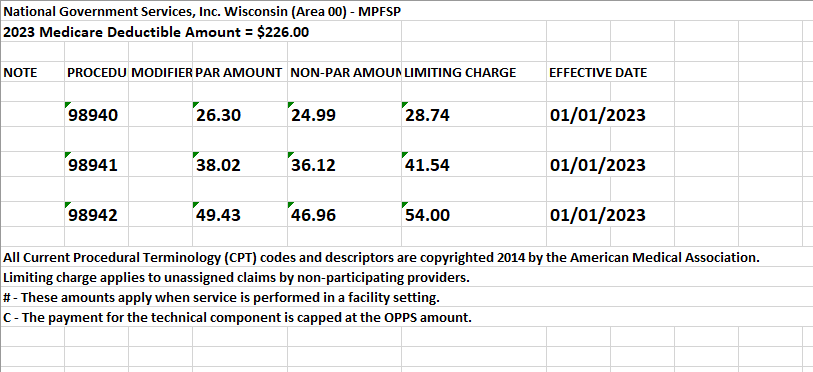

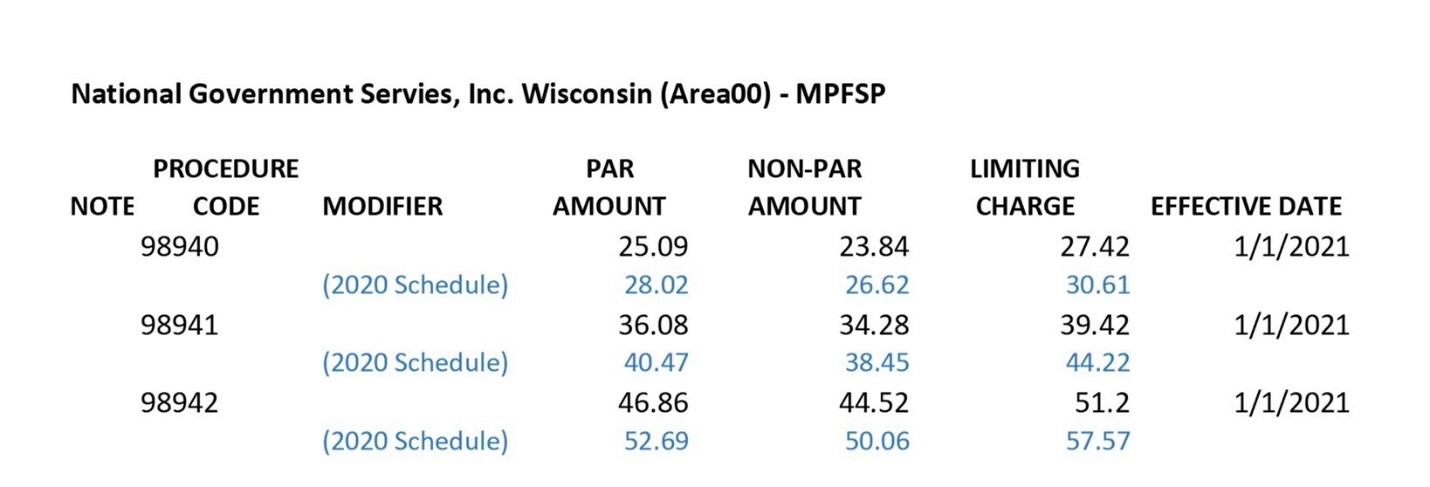

Kiplinger recently shared information from the Centers for Medicare & Medicaid Services reporting that Medicare Part B premiums will jump dramatically in 2022. An increase of 14.5% or $21.60 from 2021. Deductibles will also show an increase of $30.00 going to $233 in 2022.

Kiplinger recently shared information from the Centers for Medicare & Medicaid Services reporting that Medicare Part B premiums will jump dramatically in 2022. An increase of 14.5% or $21.60 from 2021. Deductibles will also show an increase of $30.00 going to $233 in 2022.